Central Okanagan Monthly Real Estate Market Summary – October 2023

The real estate landscape in British Columbia is experiencing a notable deceleration, with various factors contributing to this slowdown. High interest rates, coupled with looming recession fears and economic uncertainties, have led to a substantial backlog of potential buyers waiting for market adjustments. Despite sluggish sales and a rise in available options, the price of a single-family home in Kelowna has shown a slight increase, maintaining a steady trajectory. This data underscores the critical importance of accurately pricing your home for sale in Kelowna, particularly in the current market climate. At Hilbert & Crick Real Estate Group, we specialize in helping you determine the right pricing strategy and connecting you with potential buyers actively seeking properties like yours!

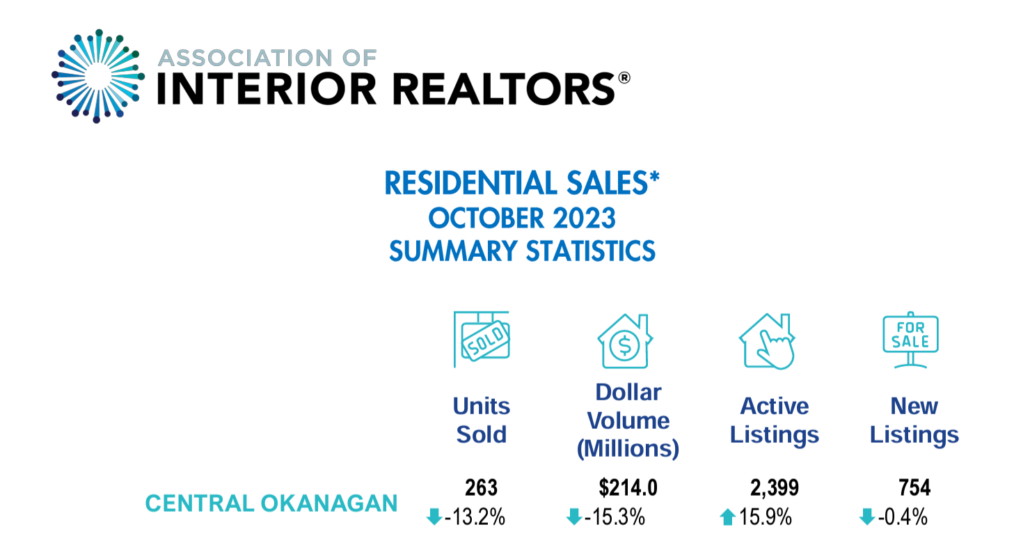

According to the latest insights from the Association of Interior REALTORS®, the residential real estate market has witnessed sales below the average for October. The persistently high-interest rates have continued to hinder market activity, resulting in 977 residential unit sales across the Association region in October. This marks a marginal rise from September’s 977 units sold but represents a modest 1.8% decline compared to October 2022. Furthermore, new residential listings have seen an uptick of 8.6% compared to last October, with 1,971 new listings recorded. The total inventory of active listings has surged by 17.1% from October last year, reaching 7,399 listings across the Association region. Notably, the South Okanagan witnessed the most substantial increase in active listings, soaring by 37.7%, closely followed by the North Okanagan with a 26.6% surge compared to the same month last year.

Fall Real Estate Activity in Kelowna – Buyers remain cautious and high interest rates are to blame!

The Association of Interior REALTORS® President Chelsea Mann provides the following insight into the local real estate market conditions.

“While we typically do see market activity ease up as the weather cools, the high cost of borrowing seems to be propelling a speedier seasonal slowdown than usual,” says the Association of Interior REALTORS® President Chelsea Mann, adding that “buyers and sellers are left waiting in the wings despite high demand with the hope of seeing some interest rate relief on the horizon.”

“The impact of qualifying for mortgages seems particularly impeding to rate-sensitive buyers as they struggle to secure financing. It is more important now than ever that buyers get pre-approved ahead of their house hunting efforts to ensure their expectations can align with their needs,” says Mann.

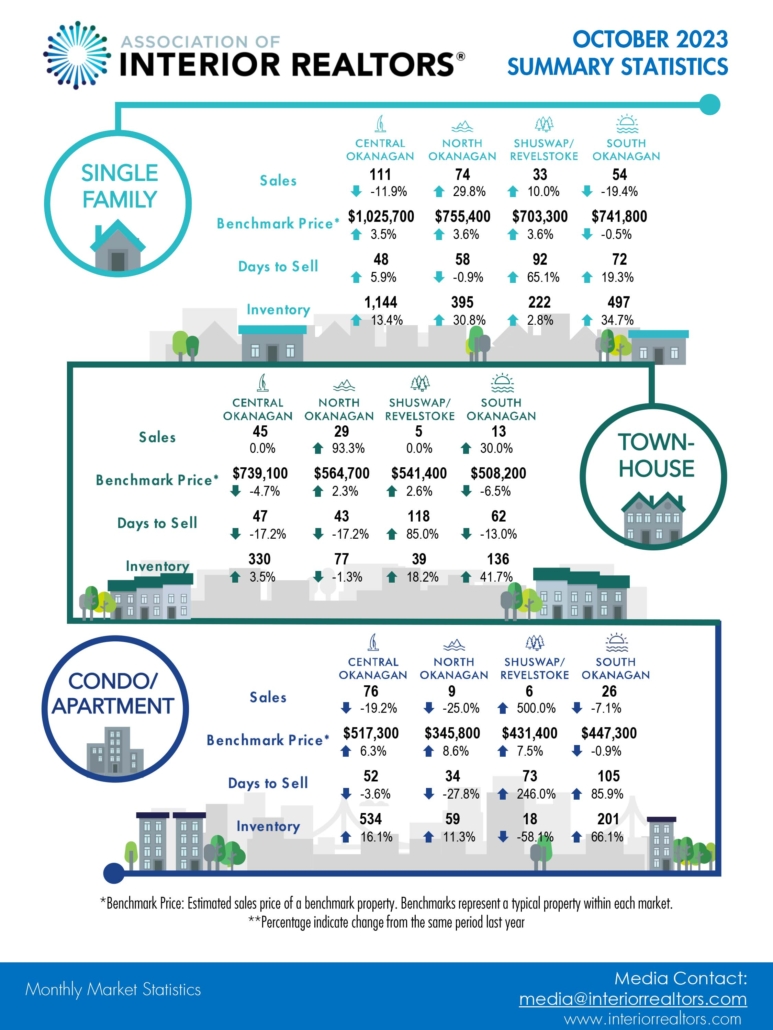

The benchmark price for a single-family home in Central Okanagan was up 3.5% to $1,025,700. Central Okanagan townhomes and condos for sale saw their benchmark price decreased slightly by 4.7% to $739,100 and rose 6.3%, $517,300 respectively. There were 1,144 single-family homes added to the market resulting in a 13.4% increase in supply during October. Townhomes had 350 units added to the market and condos saw 534 new units added to the real estate supply. The days to sell a home in Central Okanagan dropped across all segments except single-family homes and are in the 47-52-day range.

The market has buyers and sellers confused about when it’s the right time to make a move. If that sounds like you or you’re considering listing your home for sale or buying a property in Kelowna, it’s important to discuss it with a knowledgeable real estate team. There are many factors involved in today’s real estate process. Talk to our team today and find out more about how we can help you get ready to buy or sell.

We’re heading into a winter market, so make sure to get in touch with us now so that we can match you with one of our pre-qualified buyers!

Leave a Reply

Want to join the discussion?Feel free to contribute!